proposed federal estate tax changes

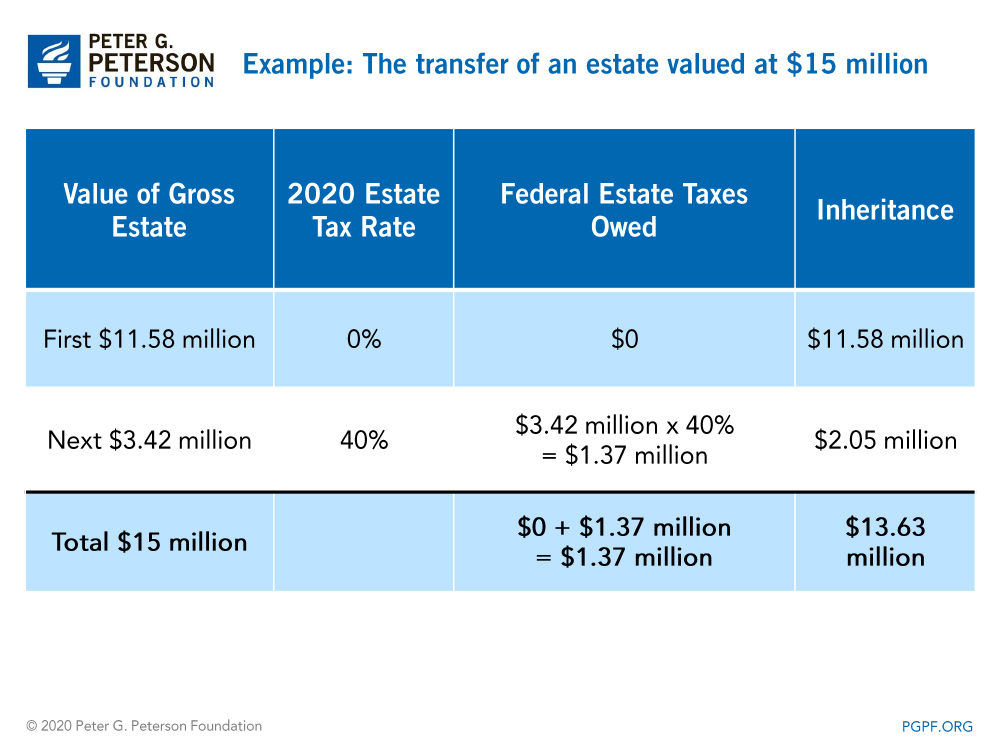

If an estate contains assets in excess of the exemption amounts those. Notably the higher federal income tax rates capital gains tax rates and 3 surcharge apply at lower thresholds for estates and non-grantor trusts than for individuals and grantor trusts.

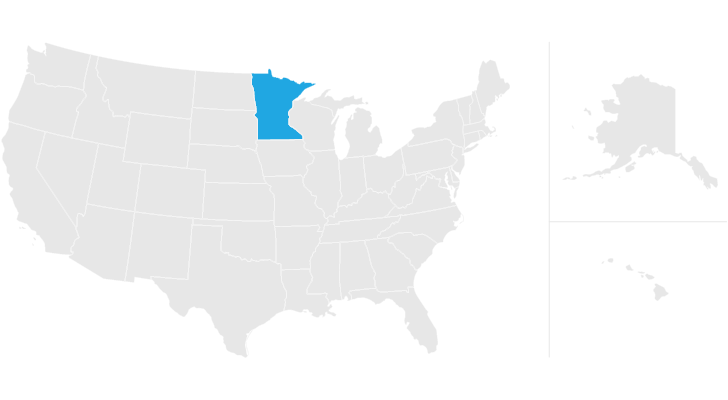

Minnesota Estate Tax Everything You Need To Know Smartasset

Here are some of the possible changes that could take place if Sanders proposed tax changes become law.

. Together with the transfer tax the net worth of this estate would be reduced by almost 40 by the two taxes. The Committee specifically proposed rolling back the 2017 Trump Tax Cuts. The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5 million inflation-adjusted effective January 1 2022 instead of.

A reduction in the federal estate tax exemption amount which is currently 11700000. Proposed Changes to Tax Law Affecting Wealthy Individuals in 2022 Finally under the proposed changes gifts and asset transfers at death would be treated as income realization as if the donor sold the property realizing any gain or loss. Estates valued over 35 million but less than 10 million would be subject to an estate tax rate of 45.

Reduce the current 117 million federal ESTATE tax exemption to 35 million. Proposed Estate and Gift Tax Changes Under a Senate Bill introduced by US. The bill would raise approximately 450 billion to pay for deficit reduction clean energy and climate investments.

Read on for five of the most significant proposed changes. Estate Tax Rate Increase. The law would exempt the first 35 million dollars of an individuals gross taxable estate or 7 million for a married.

Decreased Estate Tax Exclusion. What would be the effective date. Reduce the current 117 million federal estate tax exemption to 35 million.

An estate tax would never make a farm insolvent owe more in. This was anticipated to drop to 5 million adjusted for inflation as of January 1. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to.

The Biden campaign proposed reducing the estate tax exemption to 35 million per person 7 million for a married couple which is what it was in 2009 while increasing the. One of the potential tax law changes that would take effect at the beginning of 2022 is a reduction of the Federal Estate Tax Exemption. Whats the proposed change.

The For the 995 Percent Act proposes a sliding scale for rates as follows. Estates valued over 10 million but less than 50 million would be subject to an estate tax rate of 50. The Effect of the 2017 Trump Tax.

One other concern of this tax is that it is based on deferred gain and not net worth. Two of the most significant proposed changes include. These changes would mainly apply after December 31 2021 but the change to the federal capital gains tax rate.

The exemption is the amount that each person is. These changes would dramatically increase the number of taxpayers subject to the estate tax and would eliminate many common estate. Reduction of the estate and gift tax exclusion currently at 117 million to 35 million Imposition of capital gains tax on appreciated assets transferred during life or at death.

The House Ways and Means Committee recently introduced a wide variety of potential changes to the tax code. The current estate tax exclusion for an individual is. The SandersWhitehouse proposal calls for decreasing the exemption to 35.

After 2025 with the reduction in the estate tax exclusion this owners estate would owe 1715334 in estate taxes. Senator Bernie Sanders called the For the 995 Percent Act the lifetime estate tax exemption would drop to 35 million from the current 117 million level for an individual and 7 million from the current 234 million level for a married couple beginning in 2022. 1 In 2010 the exemption was raised to 5 million and later to 117 million in 2018.

It includes federal estate tax rate increases to 45 for estates over 35 million with further increased rates up to 65 for estates over 1 billion. Estates valued over 50 million but less than 1 billion would be subject to an. And then gifted identical replacement property.

On March 25 the For the 995 Percent Act the Act was proposed in the Senate which if enacted would result in the most extensive changes to the federal estate and gift tax in decades. Both Senators and Representatives have proposed increasing the tax rate of taxable estates. Additionally these proposed tax rates would apply to taxable estates worth up to 1 billion.

The proposals two main components would invest 80 billion over the next 10 years in the IRS for tax enforcement and compliance and impose a 15 corporate minimum tax on the approximately 200 largest corporations. The estate tax exemption represents the amount each person is permitted to pass on free of any federal estate tax at death. For the vast majority of Americans the federal estate tax the death tax has been a non-issue since 2010 when the exemption was raised to 5 million and indexed for inflation.

The maximum estate tax rate would increase from 39 to 65. Kristen Bennett and Stephen J.

What Are Estate And Gift Taxes And How Do They Work

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Where Not To Die In 2022 The Greediest Death Tax States

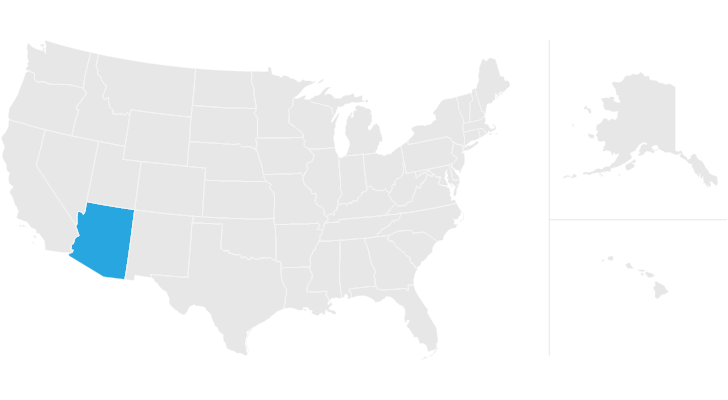

Arizona Estate Tax Everything You Need To Know Smartasset

What Are Estate And Gift Taxes And How Do They Work

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Estate Tax Law Changes What To Do Now

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

How Could We Reform The Estate Tax Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

How Could We Reform The Estate Tax Tax Policy Center

How Do State Estate And Inheritance Taxes Work Tax Policy Center

2018 Real Estate Tax Reform Guide The Bateman Group Estate Tax Online Real Estate Getting Into Real Estate