social security tax netherlands

A nominal contribution of approximately EUR 1522 including EUR 385 own-risk to be paid to the health insurance company and. Contact the Employee Insurance Agency UWV Contact the Dutch Social Insurance Bank SVB Call the Dutch Tax and Customs Administration.

Netherlands Tax Income Taxes In The Netherlands Tax Foundation

Have to pay social security taxes to both the US.

. You are obliged to file an income tax return in the Netherlands when you have been invited to do so by the Dutch Tax Authorities or when you expect to have to pay more than EUR. And Dutch systems you can establish your exemption from one of the taxes. The Tax tables below include the tax rates thresholds and allowances included in the Netherlands Tax Calculator 2022.

If you are self-employed and would normally have to pay social security taxes to both the US. And Dutch sys-tems you can establish your exemption from one of the taxes. If you are self-employed and would normally have to pay social security taxes to both the US.

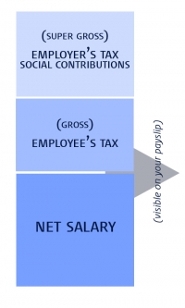

Employers may provide such items. The work-related costs scheme allows employers to provide some benefits tax free such as travel allowances study costs lunches and Christmas hampers. The wage withholding tax consists of one amount made up of wage tax and social security contributions.

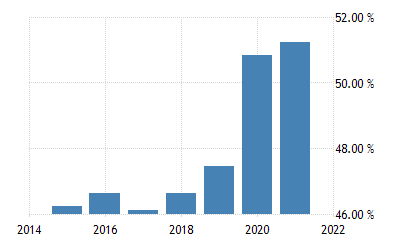

31 055 538 5385 Any further questions. AOW General Old-age Pensions Act. The Netherlands has published in the Official Gazette the regulation from the Ministry for Social Affairs and Employment that sets the social security contribution rates for.

Netherlands Residents Income Tax Tables in 2022. However your personal situation type of work residency. If you reside in the.

National insurance premiums premiums social security Total premium for the national insurance is 2765 which is divided in. An income-related contribution 67 on income. And Dutch sys-tems you can establish your exemption from one of the taxes.

The Netherlands has published in the Official Gazette the regulation from the Ministry for Social Affairs and Employment that sets the social security contribution rates for. If you reside in the. As business owners and working people you know that wage and take-home pay are often very different after.

In addition to the Dutch social security taxes that cover old-age disability and survivors benefits the agreement also includes the Dutch taxes that cover health and sickness insurance benefits. Salary social security and payroll tax for the Netherlands. SOCIAL SECURITY TAX TREATY link to text According to this agreement you are either insured for social security in the Netherlands or in the United States.

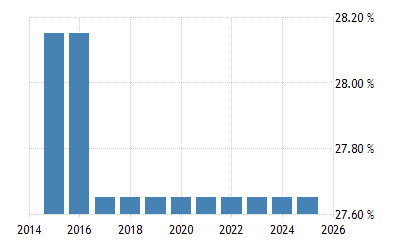

The employers social security contribution is 1286 of the employees salary. And pays it periodically to the Dutch Tax Administration. Employer Contributions in Netherlands.

The Netherlands is a socially conscious country and higher earners can expect substantial taxation on their salary up to 495. If you reside in the United States write to the Social.

Social Security Contributions In Canada Revenue Rates And Rationale Hillnotes

Government Expenditure On Social Protection Statistics Explained

Taxes And Social Security Leiden University

Distributional Effects Of Applying Social Security Taxes To Employer Sponsored Health Insurance Premiums

Figure Organizational Structure Of The Dutch Tax Administration Download Scientific Diagram

Germany Debates Tax Cuts Amid Rapid Rise In Revenue Wsj

Netherlands Social Security Rate For Employees 2022 Data 2023 Forecast

Payroll Tax Netherlands Safeguard Global

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Netherlands Social Security Rate 2022 Data 2023 Forecast 2000 2021 Historical

Netherlands Working From Home Due To The Coronavirus The Dutch Tax Impact

Tax And Customs Administration Wikipedia

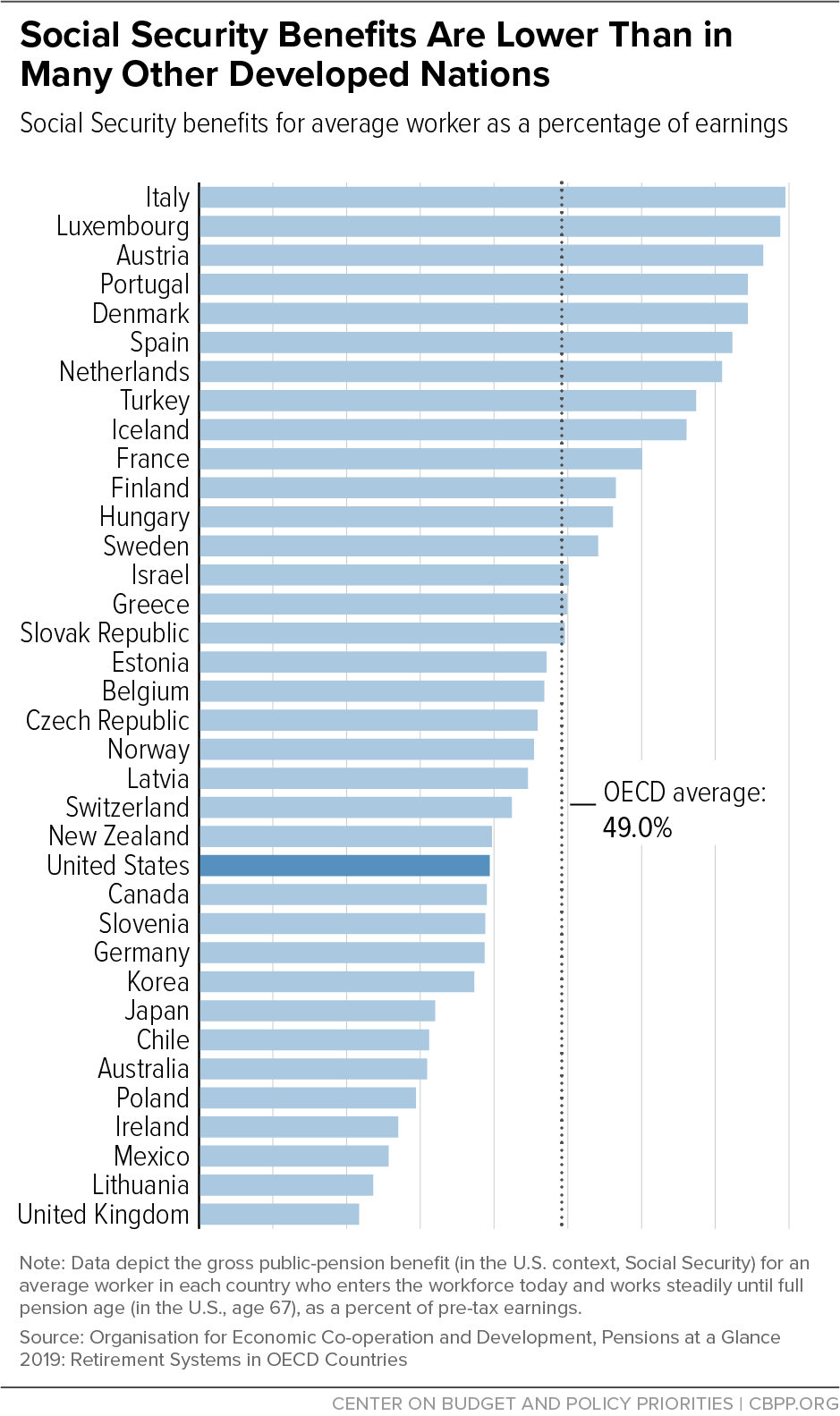

How Does Social Security Payments In The Us Compare To Other Developed Countries Chart Topforeignstocks Com

Does The Employer Share Of Payroll Taxes Matter Tax Sage Network

Why Do The Tax People In The Netherlands Get Money Out Of My Employment

Netherlands Peo Employer Of Record Services Velocity Global